Navigating AI in Finance: A Guide for Enterprise Implementation Success

Key Challenges of Implementing AI in Finance

Financial enterprises embarking on AI journeys must overcome several significant hurdles to ensure successful outcomes. Understanding these challenges is the first step toward developing effective implementation strategies.(1) Regulatory Hurdles and Explainability

Regulatory complexity tightly constrains the use of AI in finance. Institutions must align AI systems with evolving rules that demand fairness, transparency, data privacy, and accountability. Agencies like the SEC, FINRA, and frameworks such as GDPR impose standards that, while not written for AI directly, significantly impact its deployment. A major obstacle is explainability. Many high-performing AI models function as “black boxes”, making decisions that are hard to interpret. The lack of transparency poses legal and operational risks in regulated financial environments, where institutions must justify decisions such as credit approvals or fraud flags. Organizations must weigh the power of advanced AI against the obligation to explain outcomes to regulators, customers, and internal teams.(2) Data Quality and Bias

AI systems in finance depend entirely on the integrity of the data. Poor-quality and biased data, whether incomplete, inconsistent, or outdated, leads directly to inaccurate forecasts, flawed risk assessments, and unreliable compliance outputs. In a sector where precision is non-negotiable, insufficient data doesn’t just reduce the value of AI; it introduces real operational and financial risk.(3) Human-AI Collaboration and Workforce Transformation

As financial institutions adopt AI, they face a fundamental shift in how work gets done. AI changes roles, workflows, and decision-making processes, raising concerns around job displacement, resistance to new tools, and unclear responsibilities between humans and machines. Organizations must invest in upskilling and effective change management to ensure AI adoption is successful. Financial professionals need new capabilities to work alongside AI, and without structured support, the shift can lead to confusion, inefficiency, or pushback from teams.(4) Talent Gap

(5) Measuring ROI and Success

One of the biggest challenges financial institutions face in adopting AI is accurately measuring the return on investment. Unlike traditional projects, AI often delivers value in ways that aren’t immediately visible in financial statements, such as better risk insights or improved customer experience, making ROI difficult to quantify. AI initiatives must directly tie to business objectives like cost reduction, revenue growth, or risk mitigation to measure success effectively. Financial institutions must account for tangible outcomes (e.g., reduced manual processing costs, increased loan approval speed) and intangible benefits (e.g., improved compliance, stronger customer trust). Without a clear ROI framework, it becomes difficult to justify continued investment or scale AI across the enterprise.(6) Cybersecurity

As financial institutions adopt AI to streamline operations and improve decision-making, they also increase their exposure to cyber threats. AI systems rely on large volumes of sensitive data and complex infrastructure, creating new avenues for cybercriminals to exploit. Traditional cybersecurity measures fall short in defending against the scale and sophistication of attacks targeting AI-driven systems. Financial enterprises must now secure their networks and the AI models, ensuring data integrity, protecting against model manipulation, and maintaining trust in automated processes.(7) Integration with Legacy Systems

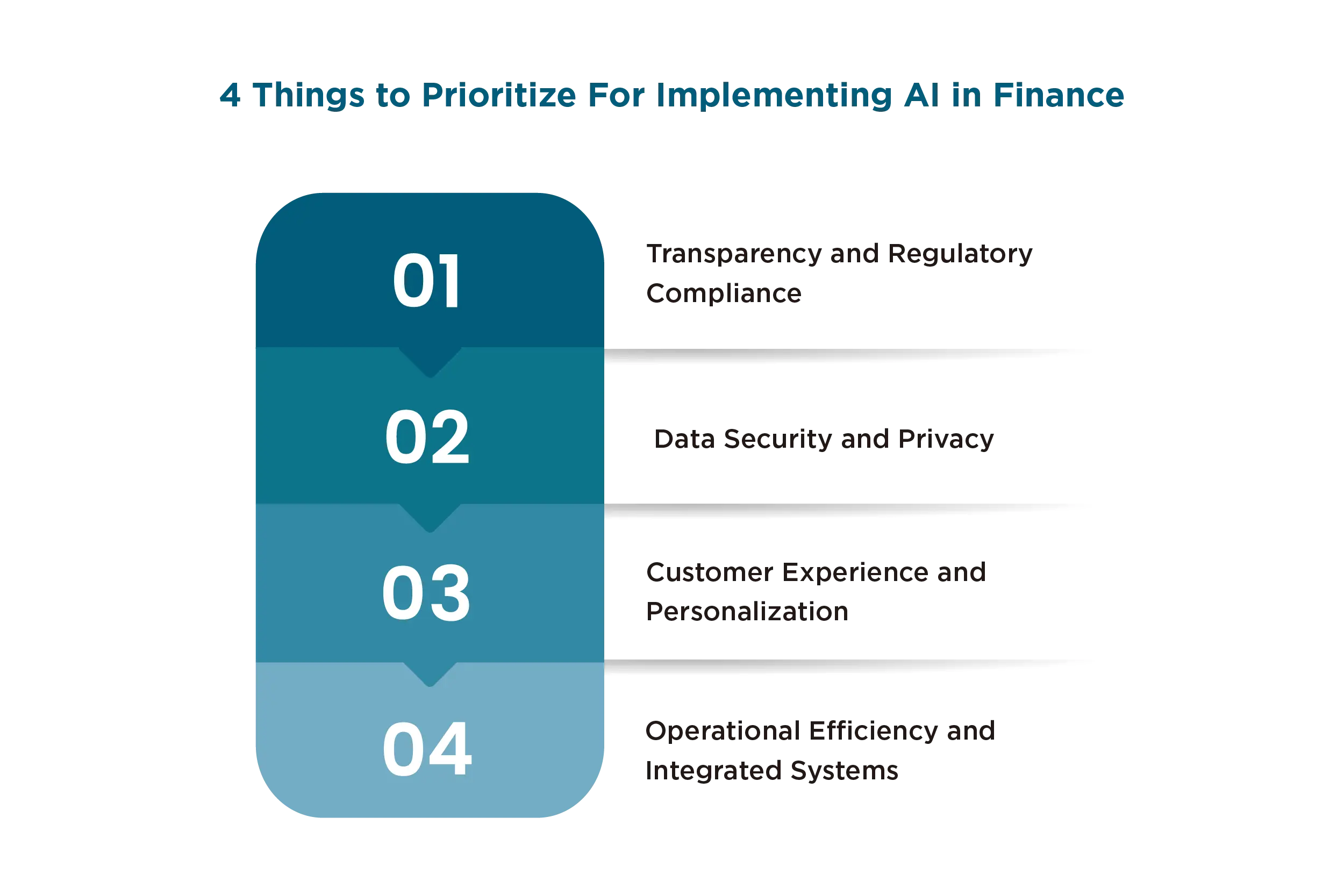

What Should Financial Enterprises Prioritize When Adopting AI?

(1) Transparency and Regulatory Compliance

Regions demand greater transparency as AI becomes more embedded in high-stakes financial decisions. Enterprises must prioritize explainable, auditable AI models to meet the growing expectations for fairness, accountability, and bias mitigation. Without this, businesses risk regulatory penalties, stalled AI initiatives, and loss of trust.

Proactively establishing strong AI governance reduces compliance risks and builds credibility with regulators and customers. In an environment moving toward self-regulation, clear documentation and model explainability enable institutions to innovate confidently and stay ahead of evolving standards.

(2) Data Security and Privacy

AI in finance depends on large volumes of highly sensitive personal and financial data, making data security and privacy non-negotiable. Institutions face regulatory penalties, reputational damage, and loss of customer trust without robust safeguards. Implementing privacy-by-design principles and strict access controls across the AI lifecycle helps meet compliance standards like GDPR and assures customers of responsible data handling.

Given these requirements, most financial enterprises adopt a hybrid AI approach, keeping critical data and models on-premise for maximum security and compliance, while leveraging the cloud for scalable, non-sensitive workloads. The model balances risk, regulatory needs, and innovation, making it the most practical and secure choice for the financial sector.

(3) Customer Experience and Personalization

For financial institutions, customer expectations have shifted toward instant, tailored experiences. Prioritizing AI-driven personalization allows firms to recommend the right products, deliver timely financial advice, and respond to customer needs based on real-time behavior and preferences. This strengthens engagement and improves customer retention in a competitive market. Meanwhile, tools like chatbots and virtual assistants extend service availability while reducing overhead.

(4) Operational Efficiency and Integrated Systems

Because most banks operate on legacy systems, integration is often the biggest barrier. Tackling this early is critical. A phased approach helps address system compatibility, data silos, and interoperability issues before they turn into operational risks. Using low-code platforms and synthetic data can also speed up deployment while reducing the burden on outdated infrastructure.

How is AI Used in Finance?

(1) Workflow Automation

● Real World Example| JPMorgan Chase Transforms Document Management with AI-Powered COiN Platform

JPMorgan Chase’s Contract Intelligence (COiN) platform leverages AI, including natural language processing and image recognition, to automate reviewing complex legal documents such as commercial credit agreements. COiN can analyze over 12,000 contracts in seconds, replacing more than 360,000 hours of manual legal work annually. By rapidly identifying key clauses and extracting critical data, the platform significantly reduces operational costs, improves accuracy, and allows legal teams to focus on higher-value tasks.

(2) Payment Automation & Fraud Detection

AI enhances payment systems by optimizing payment routing, automating invoice processing, and enabling real-time fraud detection. AI models analyze transaction patterns to detect anomalies instantly, preventing fraudulent payments before they occur. These AI-powered systems continuously learn and adapt to emerging fraud tactics, significantly reducing financial crime.

● Real World Example|HSBC Harnesses AI to Combat Financial Crime

HSBC uses AI to detect financial crime more accurately and efficiently, analyzing over 1.35 billion monthly transactions. Their partnership with Google led to a system that finds up to four times more crime and reduces false positives by 60%. HSBC ensures compliance and customer trust with responsible AI practices and strong data safeguards.

(3) Risk Management & Predictive Analytics

AI revolutionizes risk management by processing massive datasets quickly to provide accurate credit risk assessments, market risk predictions, and operational risk insights. AI models incorporate alternative data sources, including social behavior and transaction history, to improve credit scoring and underwriting decisions. This holistic approach reduces default risks and enhances portfolio management.

● Real World Example| Wells Fargo Uses Explainable AI to Improve Credit Decisions

Wells Fargo is applying advanced AI and machine learning to strengthen credit risk assessment, fraud detection, and loan decision-making. By combining models such as Convolutional Neural Networks (CNNs) with traditional approaches, the bank has enhanced the accuracy and transparency of its credit evaluations. Through Explainable AI (XAI), Wells Fargo can justify AI-driven decisions to customers and regulators, promoting fairness and accountability. These innovations have led to higher loan approval rates, reduced bias, enhanced fraud prevention, and increased customer trust.

(4) Personalized Customer Service

AI-driven chatbots and virtual assistants are revolutionizing customer interactions by providing personalized, 24/7 support. These intelligent agents handle complex queries, offer tailored financial advice, and assist with transactions, enhancing the customer experience while reducing operational costs. AI can also predict customer needs and recommend products based on individual financial behaviors.

● Real World Example| Federal Bank’s Virtual Assistant Redefines Digital Banking

Federal Bank’s AI assistant Feddy has transformed customer service for over 10 million customers by providing accurate, context-aware responses in natural language. Developed in partnership with Google’s platforms, Feddy has reduced false positives, increased customer satisfaction by 25%, and now handles over 1.4 million queries annually.

(5) Regulatory Compliance

By automating compliance monitoring and regulatory reporting, AI helps financial institutions keep pace with evolving laws and standards. Natural language processing (NLP) enables AI to interpret regulatory texts and proactively flag potential violations. This reduces compliance costs and errors while ensuring adherence to stringent regulatory frameworks.

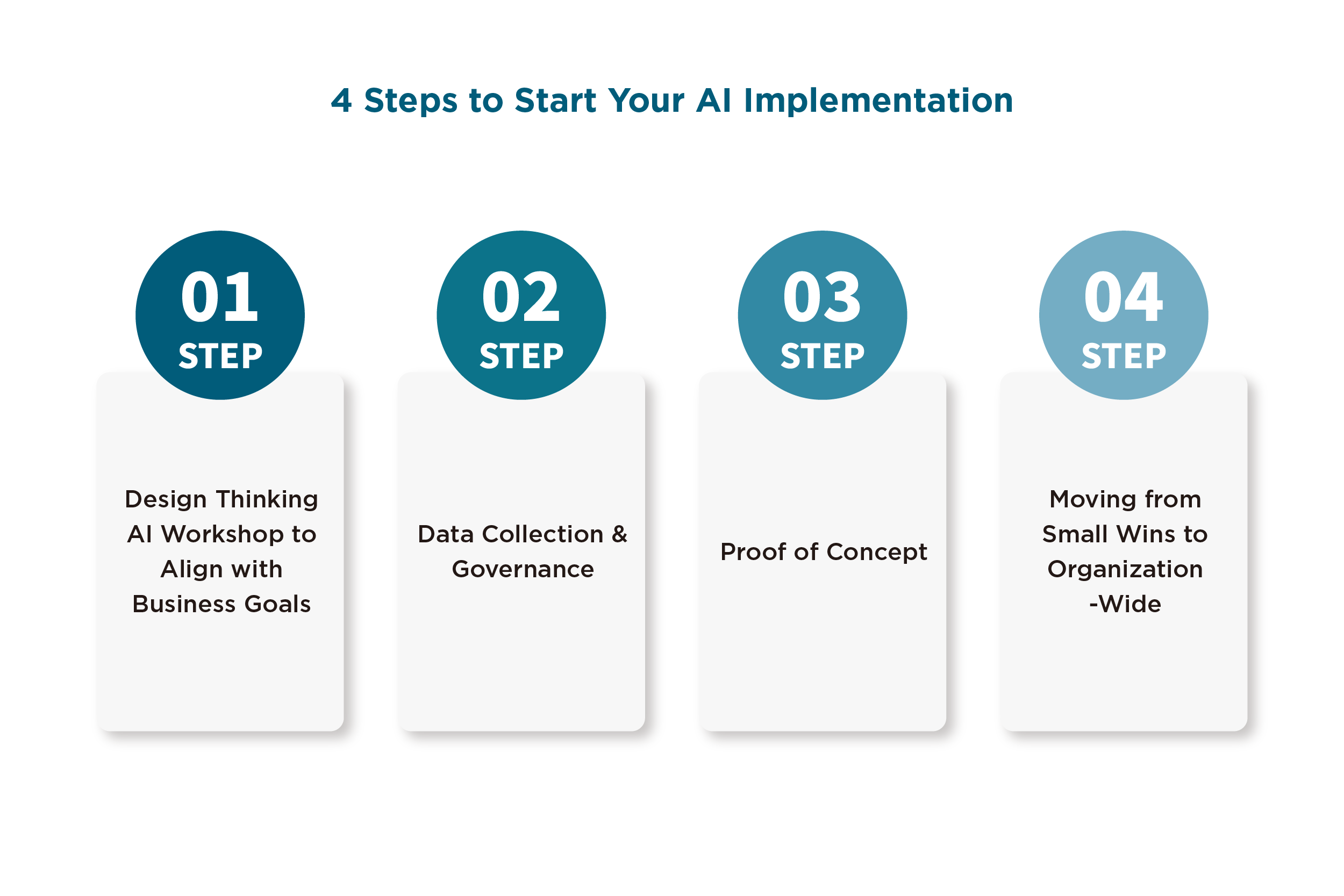

From Pilot to Production: A Roadmap for Scaling AI in Finance

Adopting AI in banking requires a structured, strategic approach that moves beyond isolated pilots to full-scale, sustainable integration. A structured roadmap providesStep 1: Design Thinking AI Workshop to Align with Business Goals

If you’re unsure where your users are experiencing the most friction, an AI workshop is the ideal starting point. Understanding the right opportunities for AI begins with identifying actual pain points, which requires cross-functional insight and structured exploration. Our AI Workshop brings together leaders from business, technology, compliance, and customer experience teams to uncover where AI can have the greatest impact. Guided by industry AI experts, the workshop begins with foundational learning on AI models, hands-on exercises such as Retrieval-Augmented Generation (RAG), and real-world use cases.

Step 2: Data Collection & Governance

AI is only as strong as the data behind it. For financial institutions, clean, complete, and governed data is non-negotiable. Here’s how to get it right:

● Audit your data: verify, don’t assume

Don’t rely on assumptions. Check if your data is usable, not just available. Are key fields complete and consistent across systems? For credit risk models, do you have access to full transaction histories, customer profiles, and repayment data? Inconsistencies here will derail your AI.

● Embed governance early

Assign clear data ownership. Define who is responsible for maintaining data quality and who enforces access rules. If you’re using personal data to personalize products, ensure anonymization and security are built into daily workflows.

● Maintain data like a live portfolio

Data degrades quickly. Set up regular processes to clean, deduplicate, and standardize formats. Enrich where needed (e.g., tagging transactions). Automate what you can to reduce errors and scale more efficiently.

● Fill gaps with synthetic data

When it comes to sensitive data, use synthetic data to model real-world patterns without exposing customers. It’s beneficial for training AI in edge cases like fraud or onboarding, where real data is scarce or protected.

Step 3: Proof of Concept Approach for Validating AI Solutions

Before scaling AI, ensure it works for your data, systems, and goals. A well-executed PoC lowers risk and proves real business value. You can scale AI step by step as follows:

● Pick use cases with real ROI

Focus on problems where AI can move the needle. Examples include shortening loan approvals, reducing false fraud alerts, or automating manual compliance checks. Define success upfront using business-driven KPIs—like time saved, error reduction, or revenue impact.

● Build with production in mind

Don’t prototype in isolation. Use tools that fit your current architecture (e.g., AWS, Azure, Snowflake) to avoid costly rework later. If it proves value, you should be able to scale it with minimal changes.

● Track the right metrics

Measure performance against both technical and business goals. Time saved, prediction accuracy, and customer satisfaction all matter.

● Get feedback early

Loop in end users early. Their feedback helps fine-tune the model and avoid surprises later in production.

Need to validate fast? We can help.

Cloud Interactive has built an AI POC Platform for our customers: a modular, industry-ready AI sandbox that helps you quickly test and validate AI applications without incurring heavy upfront costs or lengthy development cycles. You can upload your data, test different models, monitor results, and choose your hosting environment based on your security needs.

Step 4: Moving from Small Wins to Organization-Wide Transformation (H3)

Once your PoC shows results, it’s time to scale. Take deliberate steps to ensure AI adds value to the organization.

● Standardize your approach

Create consistent processes for building, testing, deploying, and monitoring models. This keeps teams aligned, reduces risk, and ensures compliance as more people get involved.

● Invest in people

AI isn’t just a tech upgrade; it’s a shift in how teams work. Upskill employees across business, IT, and data teams. The goal is shared ownership, not just handoffs.

● Set up continuous monitoring

AI models don’t stay accurate forever. Build in regular performance checks to catch drift, track ROI, and make improvements over time. Real-time monitoring is key, especially in high-risk areas.

● Promote early wins

Share success stories across the company. Show how AI reduced manual work, improved accuracy, or boosted customer satisfaction. This builds trust, drives adoption, and helps secure executive support.

The Key to Successful AI in Finance: User-Centric Design

Successfully adopting AI in financial services takes more than advanced models; it demands alignment with regulatory standards, data integrity, seamless integration, and, most importantly, the system’s users. That’s why human-centric design is crucial in the adoption of financial AI. AI tools must be explainable, trustworthy, and tailored to the workflow in highly regulated environments. When users understand and trust the technology, adoption improves, risks are reduced, and outcomes become measurable and sustainable.At Cloud Interactive, we bring 15+ years of experience in enterprise custom software and digital transformation services, guiding leading financial institutions from strategy to scalable implementation. As a certified IBM partner, we leverage cutting-edge tools like IBM Watsonx.ai to turn complex challenges into practical, ROI-driven solutions. Our one-stop AI development service ensures that your AI initiative is not only built right, but built to last. If you’re ready to explore how AI can truly transform your organization, we’d love to share insights and explore how we can support your journey.

By Cloud Interactive

Meet the masterminds behind the curtain at Cloud Interactive. We're not just software developers - we're also a content crew fuelled by caffeine and a thirst for knowledge. We translate tech jargon into plain English, dissect industry trends, and craft helpful tips that are informative and engaging. So, buckle up and join us on a journey through the ever-evolving and exciting world of technology!